In effect, trading breakouts can be the tempting way to trade. This is because the market has been rising (or falling) in a given direction. This means that the idea of success for a trade is seemingly apparent just from the chart (or commentary). Thus the trader jumps in and finds that the trade moves in a horizontal perhaps volatile way or retraces (or reverses).

Temptation is a key driver of trading, because it has a pull to get over the barriers to what it is like being in a trade. The reverse is a kind of aversion to being in a trade, from being beaten down too many times.

Once in a trade, the landscape is different. It is now an emotional issue as well as a host of other important factors, the tempation has disappeared.

Breakouts can actually be very complex moves. They tend to happen from reduced volatility, but that can go on for a long time, relative to the traded time frame. To breakout is to move decisively over a support or resistance level.

Why this is hard, can be seen from the way a Forex pair behaves at a kind of induced recurring resistance or support, that is the big figure.

To give an example, when USD/JPY approaches 100 or a similar number, it may hit it, reverse, try again, or get over it and be pulled back down. There are lots of market events which conspire to absorb momentum around support or resistance. Support or resistance is oftentimes based around value levels, for example the big figure or half way between. However it can also come from trend lines, and other technical levels, as well as fundamental factors which have in effect given the market different ways to go.

An alternative to trading breakouts is much less tempting. This is to get in at lows for a move up or highs for a move down. That is, to do the reverse of a breakout and fade the move. These are also prone to the same issues as breakouts. So such a trade can be refined by looking for factors which may indicate a market turn. These can be technical and fundamental.

Markets turns can come from or be seen emerging from technical events. For example, the beginning of a trend can come from a period of low volatility (in effect a breakout). However the trader is looking for technical clues that such an event is happning, rather than being pulled into a mometum trade. This also grounds the trade in the horizontal (perhaps volatile) move, rather than in a more vertical move which may be ending.

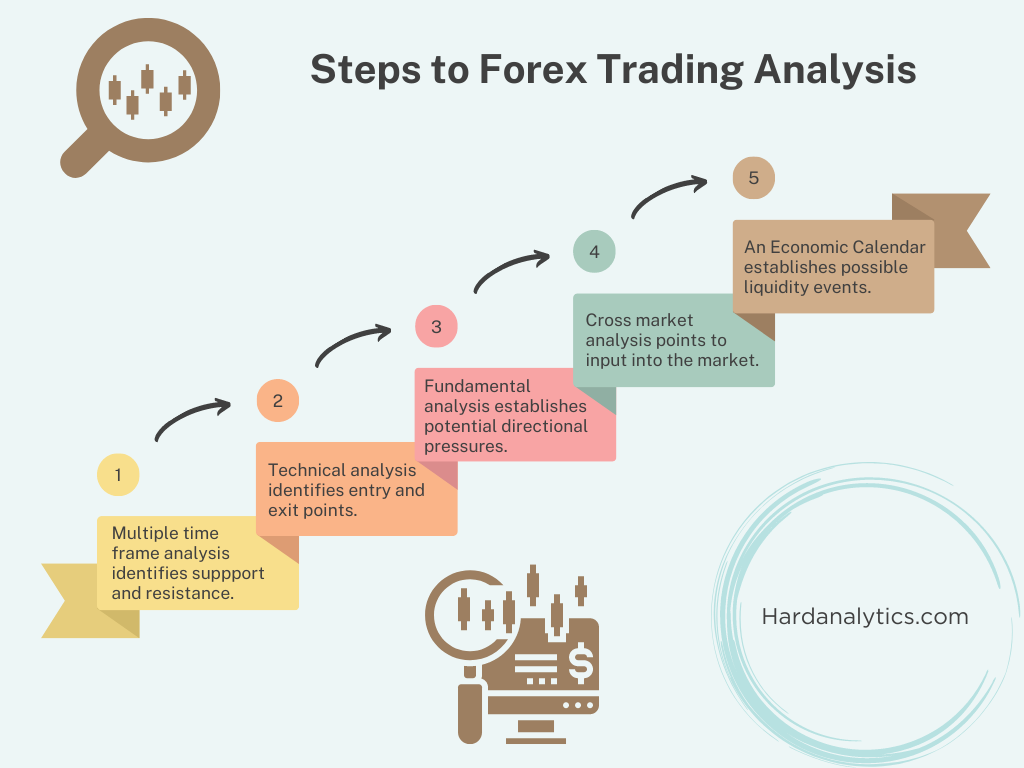

This is like looking for the detail as a clue in a complex environment, rather than the broader picture. The broader picture is still important, and to some extent can be captured in mutiple time frame analysis, where the trader looks at the chart at different time frames, and gets a sense of the intersection and interplay of potential movement. The broader picture can be captured in fundamental data as well, for example conflicting news, or an exhaustion from a particular direction, contingent on news or other data.

Such an approach can ground trading in the chart, rather than rigid structures, which may be better performed by algos. Perhaps the human factor is one which should be traded on, despite the difficulties this brings from emotional issues emerging dynamically from trading.

Emotional factors can best be deal with by repeated trading, which is why a demo account can be a good idea, by training the mind in different market conditions. However there is arguably no substitute for a live account, to really feel the market. Perhaps the emotional factor can be used as well, to provide fail safes to exit trades which may feel wrong, even if they seemed right (or were entered for 'wrong' reasons).

All this is magnified in day trading, eveything moves very fast and there may be no possibility except to follow something algorithmic. So the shorter the frequency, the more an algoirthmic approach may be required.

Algorithmic does not necessary mean robots, it can also be a tight structure defining the trading choices of the trader. Choice is still used, as the trader has the option of choosing to do something different, even if this is not what happens. The problem with this approach is the problem with any rule based approach, that is can generate complex rule sets. However a kind of cohesion of emotions and intuition can help keep a rule set dynamically pruned. But the rules are there to set and guide the trade.

The demands of trading mean that traders with the potential for errors for a while host of reasons, may wish to leave it to robots (which means accepting drawdown).

An important factor for those who want to trade on their own behalf, is money flow. For example, the boosting of a key index, can indicate a market sentiments that will push up other markets. At the same time, such an event may also pull money out of other markets.

However this sense of coherence between asset classes is a key factor in trading and can be a pointer to a breakout, as it narrows the possibilities into a tighter range. In effect clearing a path for a market to move, until a whole host of factors upend the move, bringing back the need for analysis for a breakout.

To some extent breakouts bypass for better or worse the need for analysis, which perhaps may traders do not with to do. Rule based trading also bypasses analysis as does automated trading, to some extent.

Analysis is not experience, but it is knowledge and in this sense is a kind of experience that may mesh well with other forms of experience, which comes from trading. In fact it can invigorate demo trading, which traders may not wish to do either.

It can come down to this: the way analysis can not provide the actual outcome can make this seem pointless and amplifying the difficulty in doing analysis. However analysis can still be key, as it provides an overall sense of the market, with layers of knowledge, which can perhaps provide a nudge and insipration to intuition.