Trade Accumulators On Synthetic Indices

|

|

Deriv Accumulators Review

Deriv offers a wide range of markets and innovates at a rapid pace. Its latest offering are 'Accumulators' which are a type of trade where the stake increases by a pre-selected percentage at each move, as long as the value of the traded market stays within a given range up and down.

Putting it another way, it's trading within a barrier on a tick chart, with a positive outcome (growth) if the market stays within the barrier and a negative outcome (stake loss) if it does not. Deriv offers a wide range of trading platforms but Accumulators may be found on the Deriv Trader platform.

Deriv Trader is the first platform which comes up after signing up, so the trader may sign up here and start trading. Deriv Sign-Up

How does an accumulator work ?

The principle behind an accumulator is to take advantage of a compounding growth rate but at the same time being subjected to the risk from a move which breaks the barrier.

Deriv Accumulators have a number of trader specified settings. The first is the stake which can be as low as $1. Next is the 'Growth Rate'. The Growth Rate is chosen from 1% or 2% or 3% or 4% or 5%.

What is the Growth Rate ?

The Growth Rate determines the percentage growth of the stake with each tick movement. A tick is each movement on the chart. So if the stake is $100, then after one tick the value of the stake with be the stake plus 5% of the stake = $105 (if it stays within the barriers). The Growth Rate chosen affects the range which the trade has to stay within.

What is the range ?

The range can be seen on the chart as a blue shaded range coming off the current tick. The barrier is based on the Growth Rate and the value of the current tick. Higher Growth Rates have narrower barriers. This means that it will tend to be harder to stay within the range for higher Growth Rates. The range is visually defined on the charts as a upper barrier and a lower barrier and shaded in between.

What happens if the trade moves outside of the barriers ?

If the trade moves outside the upper or lower barrier then the stake is set to 0 and the trade ends. Thus the trader loses the stake if the trade does not stay within the range. So the risk is that the trade moves outside of the barriers defining the range and the reward is that it stay within.

The trade will breach the barrier at some point, the trade strategy is to be able to exit from the trade before this happens (or the tick limit is reached). Staying till the tick limit is reached is optimal in terms of growth potential, as this will provide the maximum growth, but not risk, as the longer the trade is maintained the greater the scope for a barrier breach. The payout is the accumulated growth plus the stake, for a successful trade.

So what analytical strategies can be performed ? Firstly, there is a tool on the chart called 'Stats' which the trader can use to gauge how often the trade has moved out of the barriers.

Tell me more about the Stats tool

The Stats tool is near the bottom of the chart. It shows a list of the number of times the market's value stayed within the barrier range, which resets to zero and adds the last stat as a new list member when it exceeds the barrier. As may be seen there can be a significant numbers of consecutive movements within the barrier. However each trade has a limit of ticks before the trade closes. The higher the growth rate the lower the number of ticks before the trade closes.

Strategy

Trading on a tick chart is a volatile trade. The trader may be looking for a lower volatility move, where the trade does not spike too much and stays within a lower range. However the possibility to spike and the narrowness of the allowed range means that the trader cannot simply choose a Synthetic Index with a lower volatility.

Volatility is a complex factor in trading. Short term trading is highly exposed to volatility, but some do want to trade on short term term time frames as part of their overall trading strategy, whether scalping or news trading. Products such as Accumulators offer a way to structure this type of trading, but remain highly risky.

What are the Synthetic Indices ?

The Synthetic Indices are a staple of Deriv available across their platform offering. Markets such as Forex are CFDs based on an underlying market, thus the value of a CFD tracks the value of the underlying market. However Synthetic Indices are not based on real markets, they are rather based on a proprietory algorithm which aims to simulate different market conditions.

The Accumulators are provided on some of the Volatility Indices, which are Synthetic Indices aiming to simulate different types of volatility. So a trader may choose a Volatility 10 Index which will tend to have a lower volatility than the Volatility 100 Index. But as noted, for the barriers this does not means that a lower volatility Index will necessarily be easier to trade (which is to say more likely to stay within the range).

To given an example, a higher volatility Index may have a greater tendency to move in a more gradual way in one direction that a lower volatility index. Coversely a lower volatility index may have more tendency to range in a horizontal fashion, but may also be prone to spikes which invalidate the trade. So the takeaway is that volatility is a complex factor even if the level may be selected via a Synthetic Index. The best way to try and appreciate this type of trading is to open a demo account.

| Feature | Description |

|---|---|

| Synthetic Indices Feature | Accumulators may be traded on Synthetic Indices Description |

| Volatility Indices Feature | Accumulators can be traded on a subset of the Volatility Indices Description |

| Deriv Trader Feature | Accumulators are offered on the user friendly Deriv Trader platform Description |

| Growth Rate Feature | The trader may choose a Growth Rate which defines the percentage growth in the stake with each tick move Description |

| Range Feature | The range defines two barriers up and down which the trade has to stay within to continue growing, otherwise the trade ends and the stake is lost Description |

| Weekend Trading Feature | Synthetic Indices are tradable 24/7 thus the trader may trade Accumulators around the clock Description |

What other platforms does Deriv offer ?

Deriv Trader is the platform which opens when the trader first opens up the Deriv trading platform. There are other platforms available via tabs on the Deriv trading platform. These include SmartTrader. From the 'Traders Hub' tab, can be found MT5, Deriv X and cTrader. These platforms are dedicated to leveraged CFD trading on both real and Synthetic markets. The trader simply opens an account from the 'Trader's Hub' for each platform they wish to use.

MT5 is a powerful < a href="https://www.hardanalytics.com/p/mt5-synthetic-indices-review-binary-com.html">multi-asset, best in class platform with a wide range of features and add ons, with an expansive, long established marketplace behind it for indicators and robots. cTrader is a multi-featured, well regarded user friendly platform with expansive and clear charting which carefully integrates features such as Copy Trading and Automated Trading.

Deriv X is Deriv's own platform offering, which provides a platform for those who plan and execute their own trades and features an automatically updating Trading Journal. Availability of Deriv's features and platforms can vary depending on the trader's region.

What is the minimum deposit to use Deriv ?

There is a $5 minimum deposit, but the minimum can vary depending on the payment method used, which include Credit/Debit Cards, Bank Transfer, Skrill, Neteller, Fasapay, Perfect Money, WebMoney, Paysafecard, Jeton, Sticpay, Airtm, Pay Livre, OnlineNaira, Trustly, Beyonic, AstroPay, 1ForYou and Advcash (payment method availability depends on the trader's region).

Crypto accounts are available in some regions, covering Bitcoin, Ethereum, Litecoin, Tether and USD Coin. For Crypto accounts, Changelly, Banxa and XanPool are also available.

Feature focus: Indicators

One way for the trader to get some kind of analytical view of the chart, is to use technical indicators. Deriv Trader has a wide range available. Market factors to indicate include trend, momentum, direction and volatility.

MACD can be useful for indicating a trend. It can also point to overbought and oversold values. These values can be helpful as they might indicate a direction change or at leats a pull back. For the Accumulator, too much of a direction change can invalidate the trade, as well as too much of a trend, that is too much momentum behind the directional move. Because it's like a balancing act then a judicious use of indicators may be helpful.

RSI is more specifically geared towards overbought and oversold signals, thus can be useful as well.

Bollinger Bands may have a utility as these show by expanding and contracting changes in volatility. For Accumulators these might point to changes in direction due to volatility limits being reached.

ATR (Average True Range) specifically aims to indicate volatility, so this may be useful to show how relatively high or low are current volatility levels. A moving average may be helpful for indicating potential direction changes and crosses of pairs of averages may point towards trends. There are plenty of other indicators on Deriv Trader, and the trader may wish to try different combinations.

One guideline for the use of technical indicators is to try and keep things as simple as possible, that is not to use too many at a given time. Technical indicators can be useful tools to indicate potential outcomes, but are not seen as reliable for indicating one outcome. But they can provide a way of structuring trading choices.

However, trading on ticks is very volatile and the trader needs to be aware this level of noise may invalidate any technical signal, so attempts to use indicators to point towards barrier breaches may be very problematic, that is indicators become reactive rather than indicative due to short term volatility. This said, finding an analytical basis for any kind of trade can be much preferable versus guessing. A demo account is a way to get a better understanding of Accumulators without risk. Deriv Demo

Comparative study

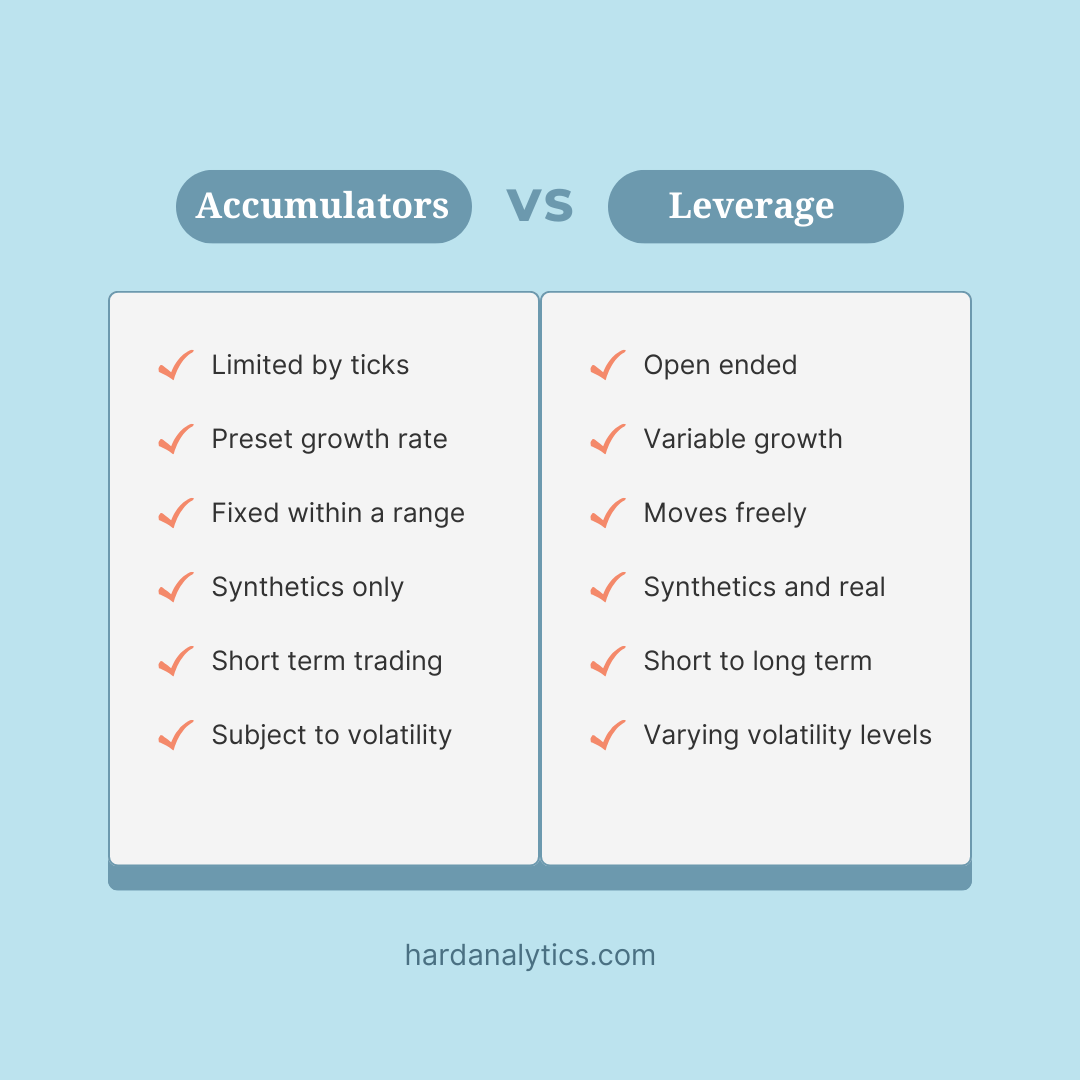

In terms of other trade types, Accumulators may be seen as a derivative which aims to find a more balanced type of move which does not exceed a barrier. Other derivative trades such as options may be seeking volatility to exceed a barrier.

Accumulators are not open ended, but they have a limit in terms of ticks. This said they can be ended early, but the trader needs to account for slippage (the spot price may change by the time the order reaches Deriv's servers). Furthermore the trader may set a Take Profit as well.

Compared with leveraged trading and Multipliers, which are available on Deriv, Accumulators have a high risk and potentially high reward in a limited time. Leveraged trading can be short term, but can also be medium and longer term. Put simply, unless restricted in time by the trader, leveraged trading gives much more scope for analysis and for letting the trade 'work out'. There are some similarities with a Stock Accumulator derivative, for example the knock out barriers and the accumulation principle, but Stocks Accumulators aim to accumulate Stocks and have a much longer term view.

However if the trader is looking for a short term speculation based around charting movement, then Accumulators offer a way to capitalise on short term movement, with the attendant risk of the loss of the invested sum from this movement.

Why trade Accumulators on Deriv ?

Deriv offers a user friendly platform with a wide range of ways to trade both CFDs on real markets and Synthetic markets, in the shape of Deriv Trader. Accumulators provide a way to potentially capitalise on shorter term trading without using options. Accumulators are limited not by time but by the number of ticks from the start of the trade. The trader can try and adjust risk by choosing a type of Volatility Index and Growth Rate.

Accumulators can potentially provide rapid cumulative growth, but also have a high risk of loss in a volatile short term trade. However the trader can try out Accumulators on a demo account and gauge the level of risk vs reward in this derivatives trade. The minimum deposit for a live account is $5 and trade sizes can be as low as $1. Deriv has a major presence in derivative based on Synthetics and Accumulators are another way to structure short term trading.