Trade On cTrader With Deriv

|

|

Deriv cTrader Review

Deriv is a long established CFD broker which offers a wide range of CFD trading platforms. Deriv is known for offering MT5 but now offers cTrader as well. cTrader is a relatively user-friendly platform with advanced integrated features including automated and copy trading. Deriv offers both CFDs on real markets (like Stocks) and CFDs on synthetic markets based on algorithms (such as Volatility Indices). On cTrader, Deriv offers both of these types of markets as well. Deriv Sign-Up

What is cTrader ?

cTrader is a platform built by Spotware which has been developed over the years. It has a relatively user-friendly interface for a platform with advanced trading features. cTrader offers comprehensive charting, with a particularly wide range of time frames, for example. It can be used for a wide range of trading, from scalping to news trading to longer-term styles such as swing trading.

Maximum leverage

Like Deriv EZ, Deriv cTrader can offer leverage up to 4000:1. However, in some regions significantly lower maximum leverage will be available.

What is Deriv ?

Deriv has been around since 1999 and has been rebranded a few times. Deriv is its latest branding and its platform offering covers a wide range of types of markets. The Deriv platform provides different trading platforms integrated in a user-friendly package. cTrader is part of Deriv's CFD offering and can be found in the Trader's Hub on the trading platform.

To find cTrader, after signing up, the trader navigates to the Trader's Hub and can then find the Deriv cTrader live account near the bottom of the page. If the trader wishes to trade on a demo account, then they can choose 'Demo' from the drop-down menu near the top of the Trader's Hub. The demo account offers $10,000 of virtual funds (not real money).

What try cTrader on a demo ?

A demo account is a good way to come to grips with a trading platform. cTrader offers a wide range of powerful features, and in this demo, the trader can try Deriv's wide range of markets on this platform without risking real money. The trader can switch back and forth between live and demo after they have created both account types.

What features does Deriv cTrader offer ?

cTrader provides a wide range of features. Upon login, there is a set of green tabs near the top left. These include 'Trade' (which the platform opens to initially), 'Copy', and 'Automate'. Trade is the main trading platform, for those who want to focus on charting-based analysis and trading. Copy is for copy trading, Automate is for robots (called cBots on cTrader). On Copy, the trader may choose other traders to copy or become a Strategy Provider themselves. Additionally, there is an Economic Calendar on the platform as well as a News Feed and charting tools.

Deriv cTrader Copy

Selecting Copy on cTrader brings up a clear list of Strategy Providers, in keeping with the approach of cTrader, to offer a user-friendly environment for what may be complex information and tasks. The tab for each Provider lists key performance metrics such as ROI as well as the minimum investment required. While a Provider may have performed well in the past, this does not mean they will continue to perform well in the future. To copy their trades, the trader selects the green Copy button.

What CFDs are offered on Deriv cTrader ?

Deriv offers Forex, Metals, Indices, Energy, EU and US Stocks and Synthetic Indices CFDs.

| Feature | Description |

|---|---|

| CFD Trading Feature | A wide range of markets are provided for leveraged trading Description |

| Demo Trading Feature | cTrader is available as a demo account as well, with $10,000 in virtual funds Description |

| Mobile Trading Feature | cTrader offers native mobile apps, which are available with Deriv cTrader Description |

| Synthetic Markets Feature | Deriv provides Synthetic Indices on cTrader Description |

| Copy Trading Feature | The trader can copy other traders or may potentially become a signal provider and have their trades copied, via cTrader Signals Description |

| Automation Feature | Trading automation with robots is available on cTrader via cBots Description |

| Weekend Trading Feature | Synthetic Indices may be traded 24/7 Description |

What are the Synthetic Indices ?

The Synthetic Indices are based on algorithms, rather than an underlying real market. The Synthetic Indices available on cTrader are the Volatility, Crash Boom, Step, Range Break, Jump, DEX, Drift Switching, Multi Step, and Hybrid Indices.

These Indices each simulate different types of markets. For example, the Crash Indices simulate falling markets while the Volatility Indices simulate different types of market volatility.

Each Index type can come in different formats for a more detailed simulation of real-world market conditions, for example, the Volatility 15 Index simulates a less volatile market than the Volatility 90 Index. Deriv cTrader has fewer Synthetic Indices than its other platforms. Those who want to trade a wide range of Synthetics on an advanced platform may do so on Deriv MT5.

What Stocks CFDs are available ?

Both US and EU Stocks CFDs are available.

Technical and fundamental analysis on Deriv cTrader

cTrader offers a wide range of technical indicators and graphical objects. Additionally, there is a news feed for those who want to keep an eye on market moving news and an integrated Economic Calendar for those who want to news trade or to avoid volatility around news releases.

What is the minimum deposit to use cTrader ?

There is no minimum deposit to fund the cTrader account by transferring into it from the Deriv account (via the 'Transfer' button), but the practical limit is $0.01. To fund the Deriv account there is a $5 minimum deposit, but this can vary depending on the payment provider. Upon sign-up, the trader can test out all platforms on a demo and create live accounts for all other platforms available as well.

To fund a Live account, payment methods include Credit/Debit Cards, Bank Transfer, Skrill, Neteller, Fasapay, Perfect Money, WebMoney, Paysafecard, Jeton, Sticpay, Airtm, Pay Livre, OnlineNaira, Trustly, Beyonic, AstroPay, 1ForYou and Volet (formerly Advcash) (payment method availability depends on the trader's region).

Crypto accounts are available in some regions, covering Bitcoin, Ethereum, Litecoin, Tether, and USD Coin. For Crypto accounts, Changelly, Banxa, and XanPool are also available.

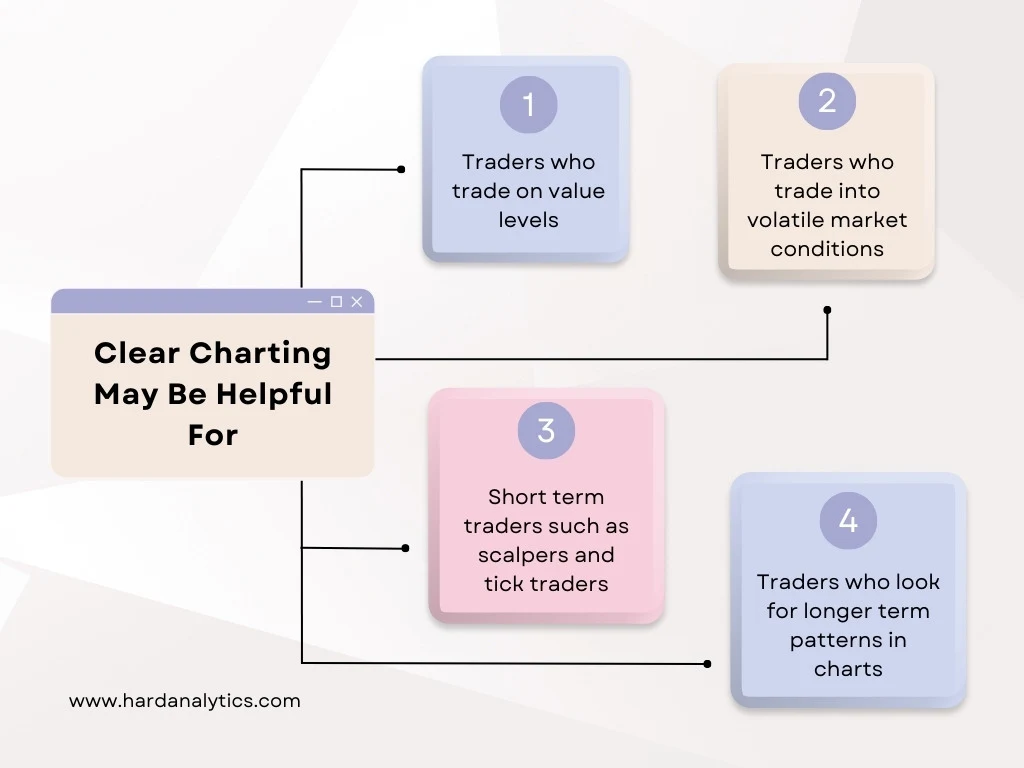

Feature focus: charting

The chart is the focus of the trading platform. cTrader can arguably be said to have a particularly clear, useful charting interface. cTrader offers a wide range of time frames (26), which is to say an unusually large number. This offers the trader the opportunity for a finer-grained analysis of the chart across multiple time frames or the capacity to hone in on a time frame for analysis or trade entry or exit.

The quality of the chart can be useful for those whose analysis focuses closely on the chart. This includes those who trade on value levels and those who news trade and trade on charting patterns. The integration of features in cTrader means that the chart can play a potentially enhanced role for those who trade using robots, from backtesting to analysis and adjustments of the trade.

The best way to see if the trader will appreciate cTrader's charting is to open a demo account and try out the platform without risk or start with a live account. Both are simple to do from Deriv's 'Trader's Hub'. Deriv Demo

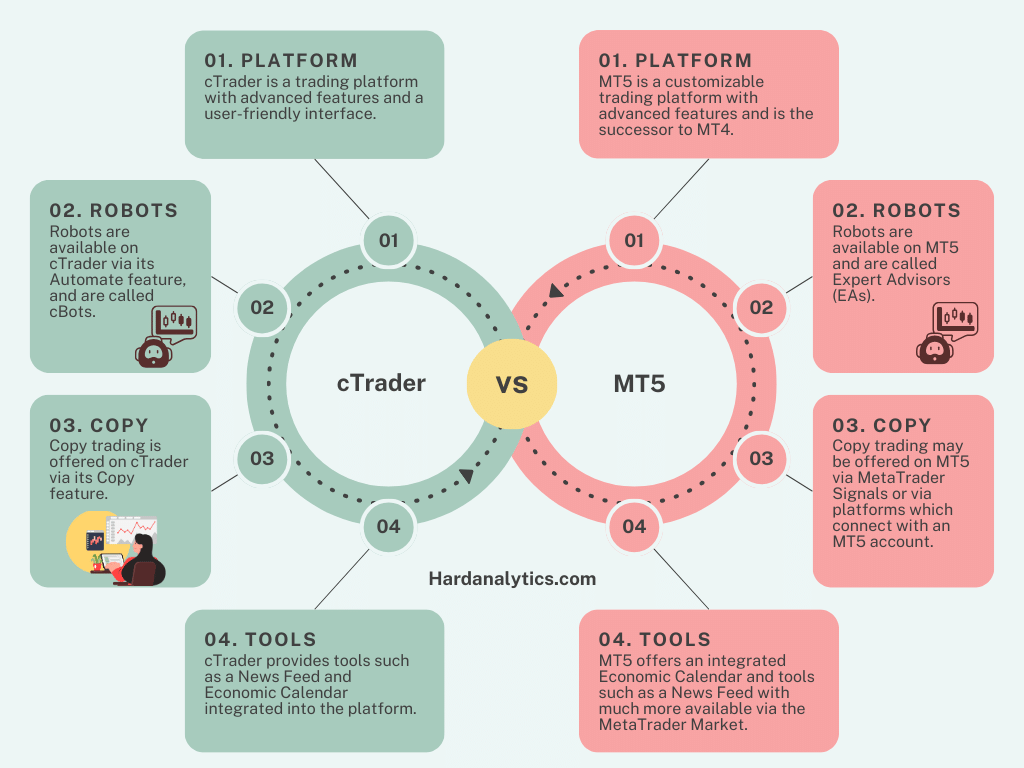

Comparative study

Deriv cTrader may be compared with Deriv MT5, as both offer real and Synthetic markets and have automated and copy trading features (though Deriv MT5 has a wider range of Synthetics). MT5 is the latest release of MetaTrader, a long-standing and popular customisable online trading platform, with a wide range of features.

cTrader and MT5 offer online trading robots, MT5's offerings are called Expert Advisors (EAs). MQL5, the programming language used for EAs is C++-like, however, cBots on cTrader are programmed in C#, so both languages are object-oriented but distinct. MT5 has a large marketplace for indicators, robots and other tools behind it called the MetaTrader Market.

cTrader and MT5 both provide copy trading functionality. On MT5, this is called MetaTrader Signals. The basic idea is similar, that one can copy the trades of signal providers, set some risk parameters, and also potentially become a signal provider, but there are differences in how these features work on both platforms. A significant difference is that MetaTrader has a larger user base and wider availability compared with cTrader. However at Deriv, one can try both, as cTrader Copy and MetaTrader Signals (on MT5) are available.

The trader should check out both platforms on a demo at Deriv and see which suits them best, demo and live accounts for both may be opened from the Trader's Hub. In terms of other brokers offering cTrader, Deriv can be seen as distinctive in that it provides Synthetic Indices as well as CFDs based on real markets.

If the trader is not interested in copy or automated trading, then they may want to consider a platform designed for the human trader. While cTrader aims to cover different types of trading and does a fine job of integrating them, the trader may still prefer a platform that is built solely for self-directed trading. Those using Deriv could try out MT5's Web Trader, which is a clear, user-friendly platform for those who plan and execute their trades.

Why trade CFDs on Deriv cTrader ?

Deriv cTrader offers a wide range of types of markets to trade on this advanced platform with integrated features such as automated trading. cTrader has advanced features, but it is arguably user-friendly as well. The trader, for example, could news trade Forex pairs and can also try the DEX Indices which can simulate action around news events.

Deriv also offers Synthetic Indices on cTrader, aiming to simulate different types of conditions that can be seen in real-world markets. However as they are not based on real markets, Synthetic Indices may be traded 24/7. The trader can test out the range of markets offered by Deriv, allied with cTrader's comprehensive range of integrated features, on a demo or live account.