| Online Broker | Minimum Deposit | Trading Platforms | Markets | About |

|---|---|---|---|---|

| Deriv | $5 Minimum Deposit | MT5, cTrader, Deriv X Trading Platforms | 100+ Markets To Trade | Deriv offers trading on user friendly Deriv X and on MT5 and cTrader, with a low minimum deposit to open an account About |

| Vantage | $50 Minimum Deposit | MT4, MT5, TradingView, ProTrader Trading Platforms | 1000+ Market To Trade | Vantage offers support for automated trading, with spreads from 0 plus commission About |

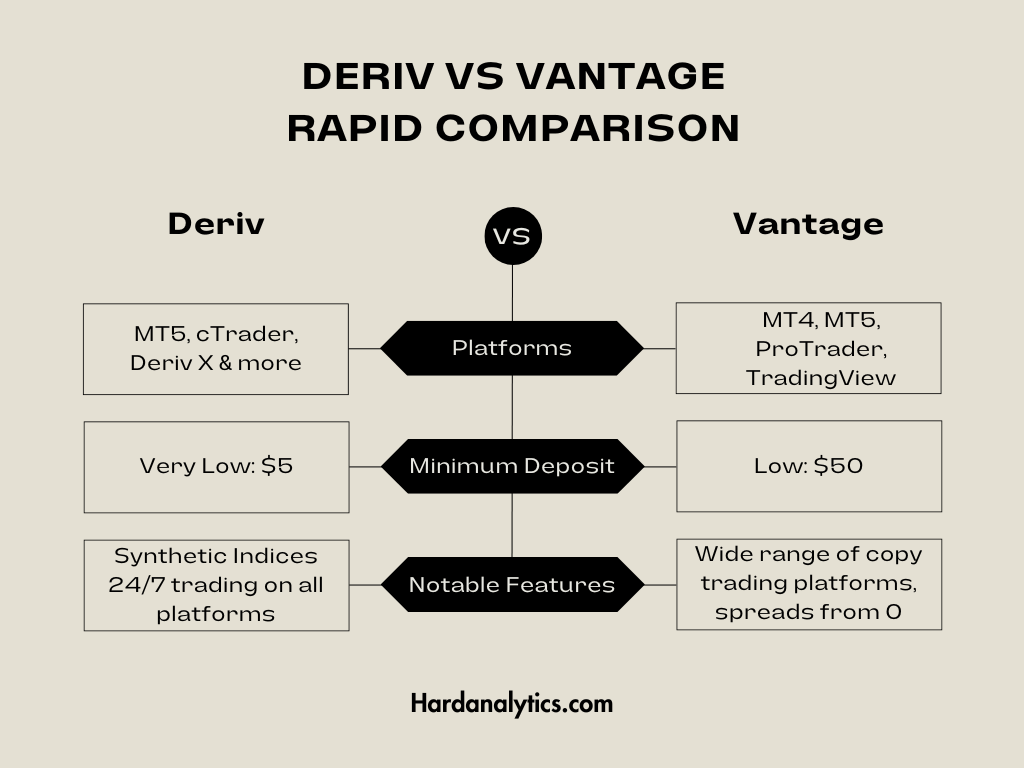

Deriv vs Vantage Comparison

This is a comparison of Deriv vs Vantage (formerly Vantage FX). Vantage was founded in 2009 with a focus on services for automated traders, but can be used by a wider range of traders, particuarly with the addition of user friendly ProTrader and the popular TradingView platform. Deriv was originally founded in 1999 (and is the successor to Binary.com) and now offers MT5, cTrader and user friendly, innovative Deriv X, along with other platforms.

Quick comparison

Vantage supports automated trading and traders who want to use ProTrader and TradingView, while Deriv has features for a wide range of traders, including MT5, cTrader and user friendly Deriv X. Unlike Vantage, Deriv offers 24/7 trading of Synthetic Indices (simulated markets). Like Vantage, Deriv provides 24/7 trading of Crypto CFDs.

Minimum deposit and account types

The minimum deposit for Deriv is $5. The minimum deposit for Vantage is $50.

- Vantage offers Standard STP, Raw ECN, Islamic and Pro ECN accounts. The STP account has a minimum deposit of $50, the Raw ECN account has a minimum deposit of $50 and the Pro ECN account has a minimum deposit of $10,000. The minimum trade size is 0.01 lots.

- Vantage's Standard STP account does not charge commissions, while the Raw and Pro ECN accounts do charge commissions. All accounts allow scalping. Vantage supports social and copy trading via ZuluTrade, Myfxbook Autotrade, DupliTrade and Vantage Social Trading (on the Vantage mobile app). The Pro ECN account offers lower commission charges and access to Interbank price feeds.

- Deriv offers a range of platforms and account types packaged into one platform. On its user friendly platform Deriv X it offers features such as a Trading Journal. Copy trading is supported via MQL5 Signals and cTrader Copy. While this page focuses on leveraged CFD trading, Deriv does provide other types of trading, including multipliers. Some products may not be available in some countries.

Markets

- Deriv offers Forex, Indices, Energy, Metals, Cryptocurrencies, Stocks, ETFs and Options, with 100+ available.

- Vantage offers Forex, Indices, Energy, Metals, Cryptocurrencies, Stocks and Soft Commodities, with 1000+ available.

| Broker | Trading Platforms | Description |

|---|---|---|

| Deriv Broker | MT5, cTrader, Deriv X Trading Platforms | Deriv offer trading on MT5, cTrader and user friendly Deriv X, with a wide range of markets including 24/7 trading on all these platforms Description |

| Vantage Broker | MT4, MT5, TradingView ProTrader Trading Platforms | Vantage allows automated trading and trading where the trader executes their own trades and has a wide range of copy trading platforms Description |

Leverage

Maximum leverage for Deriv is 1000:1. Maximum leverage for Vantage is 500:1.

Commissions

- Deriv does not charge commissions for Forex, Stocks, Indices or Metals.

- Vantage has a commission charge of $3 per lot per side for ECN trading, except for its Pro ECN account which has a commission charge of $1.50 per lot per side.

Online trading platforms

Deriv offer MT5, cTrader, Deriv X and a range of other platforms. Vantage offers MT4, MT5, TradingView and ProTrader.

Foundation

Deriv was founded in 1999, while Vantage was founded in 2009.

Payment methods

Both brokers support Bank Transfer, Credit/Debit Cards, Skrill and Neteller. Deriv additionally supports WebMoney and Trustly. Vantage additionally supports China UnionPay, Fasapay and AstroPay.

Why Deriv or Vantage ?

Traders who want to trade on MT4 and MT5 with a broker supporting automated trading and providing ProTrader and TradingView may do so at Vantage. Traders who want to trade a wide range of types of markets on MT5, cTrader and user friendly Deriv X and trade 24/7 may do so at Deriv.

Comparison summary

- Both offer CFD trading

- Each provides MT5

- Vantage additionally offers MT4

- Deriv additionally provide Deriv X and cTrader

- Vantage additionally offers ProTrader and TradingView

- Both allow EA robots

- Deriv has 24/7 trading